Amazon made a significant public pledge to invest $2 billion in climate change solutions.

I’m always happy for more dollars focused on this space of course and am happy to celebrate this and other similar announcements. That said, I think we should also note that this is a logical approach to running a business. High-margin tech companies are well-positioned to invest in their futures (across every dimension, not just from a carbon abatement perspective). So, they’ve already been doing that by making the switch to powering their operations from renewable energy (which saves them money). Now, the largest players are starting to make commitments to go carbon neutral (or in the case of Microsoft, to offset their legacy emissions as well). This is good for the planet and its great marketing.

Even more important for the business is that they can see how the policy environment is moving towards carbon neutrality (by 2050 if not earlier) — I would guess they have essentially baked in this change for their long term planning. So, these commitments and investments keep them ahead of the curve on policy and prevent them from needing to play catchup. At a second-order level, they also create opportunities to explore new lines of business, offering products and services that help reduce carbon emissions to other businesses in the future, once they have mastered it for their own business (Amazon Web Services is probably the best example of this).

Because the carbon neutral by 2050 target is so far away (and not yet official policy in the U.S.), it can be easy not to make the connection between this future state of the world and decisions today.

So, good for Amazon, they get some credit for investing in reducing emissions and making their business more efficient, which is good for their bottom line, their brand, and reduces regulatory risk. I’m glad they’re getting that credit — it will help to cajole other businesses in that direction as well! But let’s remember — just like the renewable purchases they’ve made, they’re not doing so because they feel bad for pandas, they are making logical business decisions about the future to reduce costs, increase efficiency, and mitigate against regulatory risk. I for one am happy that these logical forward-looking decisions will also help address climate change. Link

Chief Executive Officer of Activate and Founder & Executive Director of Cyclotron Road Ilan Gur highlighted issues with the U.S.’s approach to innovation and proposed a few solutions: 1) fund solutions, not just research, 2) embrace industry-funded research, and 3) focus on what matters for the future. I generally agree with the points in his post, and second his point that it is wild how low of a priority energy and climate R&D spending is relative to other areas.

Another solution I would highlight — there is much we can do to improve our national lab system. These are a fantastic set of research institutions, but are not well geared for commercializing technology or collaborating. Incentives related to employment, promotion, and compensation aren’t well aligned for scientists to try to spin their technologies out of the lab and start a new business (it’s not impossible, just very difficult). There is a lot we can do to better align incentives for commercialization.

This does not mean of course that we should abandon basic research, or that there isn’t value in fundamental science in general — I am a proud son of an employee of Fermi Lab, a national lab focused on high energy physics whose discoveries have very little to do with new commercial applications.

One positive step in the right direction are the lab embedded entrepreneurship programs, which were Gur’s brainchild — he founded the program at Lawrence Berkeley National Laboratory and continues to play an active role in that space. Link

Congrats to our friends over at Prime Impact Fund: PRIME recently announced the close of their $50 million fund. Like Clean Energy Trust, Prime invests catalytic capital, although the specific sources of funding are different (PRIME draws on program-related investment and donor-advised funds). As part of this close, PRIME also announced an initial tranche of investments, including Clean Energy Trust portfolio company C-Motive Technologies. Link

Speaking of new climate investment funds, legendary venture investor Chris Sacca announced Lowercarbon Capital, which is making investments in cleantech and sustainability. Link

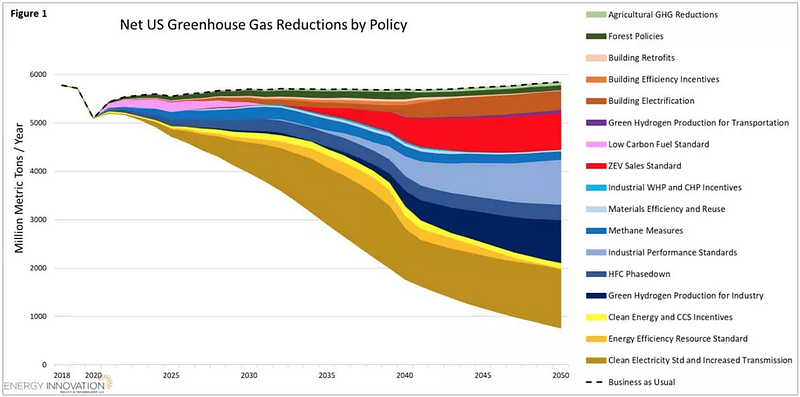

The House Select Committee on Climate Crisis released their Climate Blueprint — high marks for its approach and attention to detail. No, this legislation is not going anywhere, but it could serve as a template for climate legislation in a future legislative session (this is how these things typically work: detailed legislation is worked on and then put on a shelf, so if there’s an opportunity to pass something in the future, folks can grab it off the shelf, tweak it, and get moving quickly on it rather than starting from scratch). Energy Innovation modeled the expected impact of the policies included in the legislation, shown below in this colorful chart:

One area near and dear to my heart: transmission. The blueprint proposes expanding FERC’s (Federal Energy Regulatory Commission) role in transmission siting, both by transferring authorities currently held at the U.S. Department of Energy and by adding new elements as well. This is a great example of an extremely practical policy change which has great bang for the buck — providing this authority doesn’t cost anything, and it enables an agency that is already steeped in permitting processes to help streamline the process for building new transmission lines (which we desperately need more of today to continue to grow the deployment of renewable energy cost-effectively).

The plan supports and includes a future for carbon capture, nuclear, and carbon taxes (which some on the left are skeptical of), but focuses on employing standards as a major mechanism to decarbonize our electricity system and to reduce emissions from transportation.

Here’s coverage of the report from Axios and Vox, and here’s the actual report from the House Select Committee on Climate Crisis.

Tesla and Rivian are both in the process of offering auto insurance products to their customers. Electric vehicles are sometimes referred to as “computers with wheels;” those computers collect a lot of data. These companies have the potential to leverage this data advantage over insurance companies to offer more competitive insurance premiums. Link

Photo by Deniz Altindas on Unsplash

Chicago area (Skokie)-based Lanzatech announced a new spinout, LanzaJet, to make sustainable aviation fuel. Link

Bloomberg Green discusses how hydrogen can offer oil and gas supermajors a path forward as the world moves to address climate change and de-emphasizes oil and gas. Link

The California Air Resources Board has put new rules in place which require all trucks sold in the state to be zero-emission by 2045 (and half zero-emission by 2035). Link

Popular car website Jalopnik profiles the cheapest electric vehicle money can buy. Link

Read more of our news and perspectives on Medium.