Interest in corporate sustainability metrics has skyrocketed in the last few years, particularly in the financial industry. With it has come a surge in demand for information related to these activities, one accommodated by existing reporting standards and frameworks produced by organizations such as the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB), CDP and the International Integrated Reporting Council (IIRC), with more being proposed by the World Economic Forum (WEF), the International Financial Reporting Standards (IFRS) Foundation and the European Union.

This data is collected and transformed by a wide variety of actors in the sustainability information industry for use by stakeholders and, particularly, investors. Given the proliferation of reporting and aggregating and disaggregating of information, over which there is no consensus, there has been widespread dissatisfaction about the lack of harmonization and comparability

In response, there have been attempts at harmonization by the standard setters, based on the assumption that it is feasible and desirable. I’m not sure it’s either.

Is harmonization possible or even desirable?

If harmonization means consensus on a single standard, then the answer is most likely no. Why? Let’s consider four major components of the context in which this ecosystem operates.

- The object of reporting: It is nonfinancial metrics that purportedly represent the sustainability of the company. This is a fuzzy concept, different for each company, depending on the context in which operates. It changes with time, the material stakeholders affected and those it wants to affect, the actions of competitors and the pressure they receive from their stakeholders, among other factors. To get a sense of this, contrast the large differences in the sustainability ratings of a given company, by different raters based on sustainability information, with the generalized agreements in their respective credit ratings which are based on financial information.

- Quantification of the information: A significant, critical portion of the information required to assess sustainability is simply not quantifiable: culture; values; processes; strategies; product responsibility; quality of management, among others. Does the existence of a sustainability strategy or a board committee constitute sustainability? What is a measure of sustainability? Inputs such as the number of dollars spent on teaching the code of ethics; or outputs such as the number of hours taught; or results such as the number of cases considered by the ethics committee and its decisions; or impact such as the change brought about in the culture of the company? Which of these four attributes are reported through ESG indicators? Which ones indicate a potential financial impact?

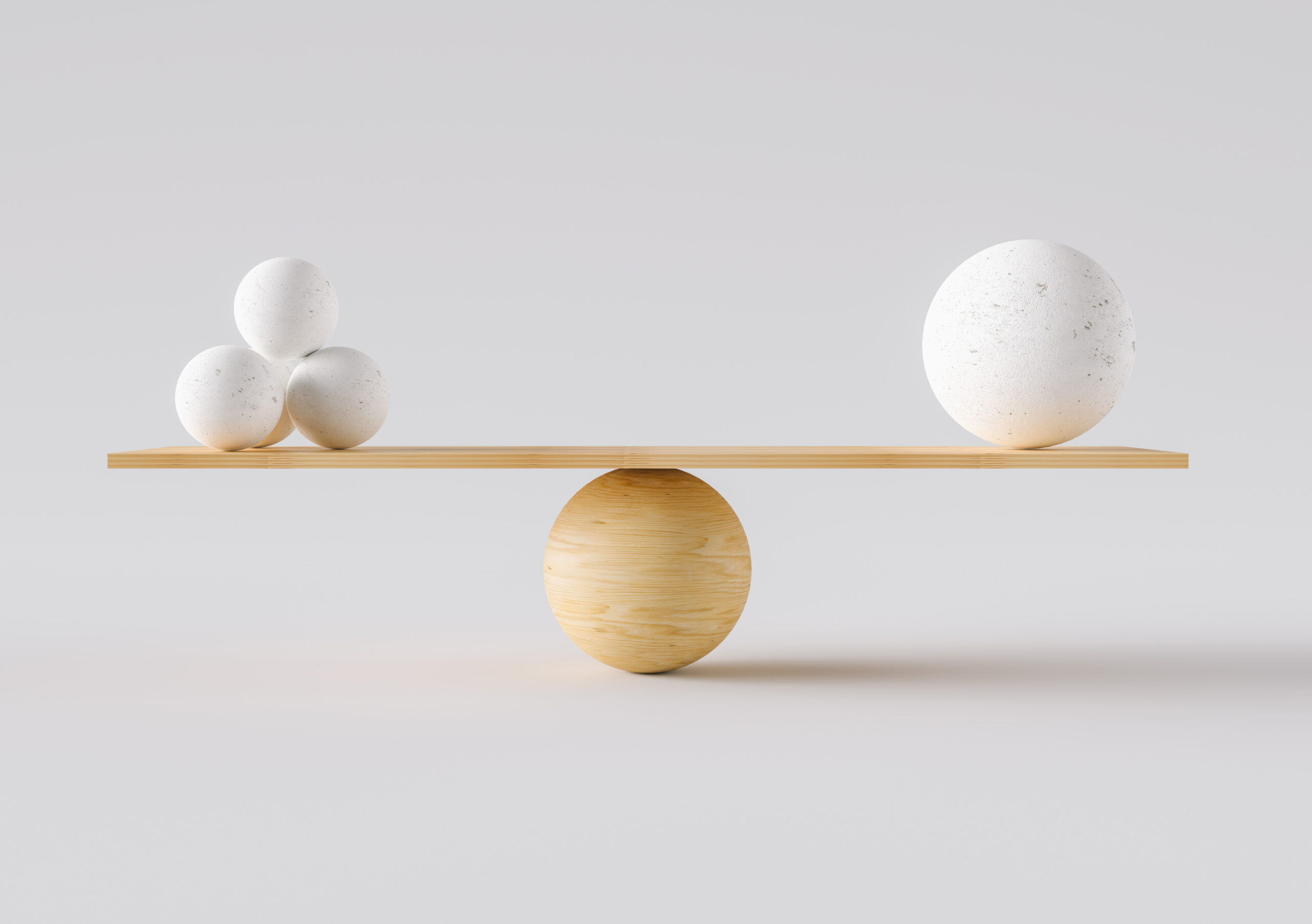

- The users of the information: Every stakeholder uses a very different lens to make their decisions — from investors to managers to the community, employees, labor unions and governments. Each group is concerned about the impact on their stakes. Most users, especially those in the financial markets, are used to the strictures of financial accounting and want information that is comparable, relevant and reliable, among other attributes. But comparability requires the reduction to a minimum set of common information and its indicators, that risk losing relevance and reliability. Comparability requires generalization, but relevance requires specificity. And reliability requires consistency of the information through time and across providers. It’s hard to achieve all three, simultaneously. A given percentage of women on the board may be quite an achievement for one company but a serious deficiency in another.

- The sustainability information industry is composed of many varied actors. Most are in it for profit, each one with its own stake and market to protect and expand. There are standard-setters (GRI, SASB et al), compilers of information (Bloomberg et al), ratings companies (S&P Global et al), index providers (MSCI et al), accounting firms (the Big Four et al), and consultants on sustainability and reporting (Sustainalytics et al). According to the Reporting Exchange, there are over 650 ratings firms and more than 500 national reporting requirements. MSCI alone produces more than 1,500 equity and fixed income ESG indices. Blomberg collects information on over 700 indicators. Will they all accept to provide the same information, the same indicators, the same reports, use the same methodology for ratings and indices? (SASB has asked them to concentrate on their indicators.)

What is possible?

Based on these considerations, it looks difficult and maybe not even desirable to achieve harmonization. The needs of investors, which are more homogeneous and focused, seem to offer the most promise but with caveats: It would require a consensus about what is meant by sustainability and its measurement.

Currently, each of over 650 sustainability raters has its own model of what sustainability means, using only quantifiable information, with their specific indicators and relative importance weighted to calculate a score. Finding consensus would require them to agree on a core set of comparable measures applicable to all companies, and another set specific to the industry, as in the SASB standards and the new WEF proposal. A third set of measures specific to each company, as proposed by the Yale Initiative on Sustainable Finance, would be added.

Comparability requires generalization, but relevance requires specificity.

This approach would please fund managers and analysts, as it would greatly simplify their work and even reduce potential legal liabilities by contending that their decisions are based on an accepted ESG reporting standard. It would enhance comparability but reduce relevance. It could disincentivize companies to differentiate themselves based on their sustainability. It also might motivate companies to gear their sustainability strategies to achieve better ratings and manage to specific indicators, not necessarily to have a better impact on society.

A broader possibility would be for GRI to accept that its standards should be useful to investors and expand them, or for SASB/IIRC to accept that theirs also must serve all stakeholders and expand them. Either should subsume proposals such as the one offered by the WEF. But to please everybody, the resulting framework would be complex and unwieldy. It would involve a big cultural change and capitulation to the standards that prevailed. It does not look politically feasible, in the medium term, that the aforementioned institutions will agree to subsume their standards into a single entity.

At the very minimum, I believe two standards will coexist — one to respond to the needs of finance providers and the other to the needs of all stakeholders. And the myriad indicators, indices and ratings provided by the extensive market of sustainability information would not disappear.

Is reduction to a single reporting standard desirable? Yes, for some, but not for all stakeholders. Is it feasible? Yes, if one is willing to achieve simplicity and comparability at the expense of relevance and impact.