Writing in the Financial Times, Henry Paulson, the ex-US Treasury Secretary, championed the creation of ‘a new asset class of healthy soils and pollinators’. The Paulson Institute has estimated the ‘biodiversity financing gap’ will be over $700 billion per year for the next ten years. While this report focuses on the public markets, the message is the same for private sector investors, who must develop innovative financial mechanisms in order to transform the goods and services provided by nature into asset classes.

Innovation in Agricultural Land Investment

Nori is looking to create an ‘API for climate change’ by using blockchain technology to increase the transparency and validity of transactions in its marketplace. Nori will work in any industry where it can find verifiable examples of carbon sequestration. Agriculture is its first source of credits, a vindication of the potential for soil-based carbon sequestration.

Beyond carbon markets, new models are being developed to fund transition finance. Typically, investment in farmland has relied on real asset strategies, buying agricultural land and leasing it to third party farmers. This creates a misaligned incentive to maximize returns from the farm over the short term. New real asset models of financing are being developed, including:

- Land acquisition and partnership with selected farmers, with agreements on management systems and monitoring and shared profits between owner and farmer. This model can include a farmer’s right to buy back the land at the end of an agreed transition period, incentivizing the farmer.

- Investment in fund structures or corporate vehicles which acquire land and operate it, giving security of land ownership (SLM Partners in Aus. beef).

- Investment in regenerative processors, traders, and brands such Rabobank’s investment in Pipeline Foods.

- Green bonds.

Isn’t soil carbon sequestration going to solve everything?

Since I wrote about the carbon markets in agriculture last August there have been many developments and corporate-backed initiatives and pilots. Two examples include:

- Bayer launched Bayer Carbon Initiative, looking to enroll 1,200 row crop farmers in Brazil and pay them for capturing carbon in cropland soils. The company has provided $5.76 million for farmer payments over three years

- FedEx invested in Indigo, citing interest in offering service to its grain marketplace and potentially buying credits in its carbon marketplace.

There is strong debate around what impact carbon sequestration in agriculture soils can have, but the debate misses the point. Carbon credits are just one ecosystem service farmers can provide, and new business models are being developed to capitalize on multiple payments, stacking water quality, nitrogen retention and carbon sequestration payments to increase profitability for changing farming practices.

Innovation in Ecosystem Service Payments

One approach is being developed by Quantified Ventures, particularly in its latest initiative the Soil and Water Outcomes Fund. The company began work in the agriculture sector trying to structure corporate bonds to make water and food corporates invest upstream in their value chains. This approach wasn’t working, and so the company started to look at a new financial system based on a revolving fund. The team is looking for investors in a fund to pay farmers a fixed fee to introduce practices and technologies promoting carbon sequestration, nitrogen retention, or improve water quality. It then looks to sell the credits and ecosystem services to downstream corporates or buyers of credits and certificates to make the money to pay investors back.

In this way, Quantified Ventures are incentivized to build the market, while de-risking the agreement with the farmer. By selling real outcomes (carbon sequestered, water quality improvements, nitrogen retention), the company is increasing the liquidity in ecosystem service payment markets compared to models relying on paying farmers for changing practices rather than the outcomes of those practices. For example, if a municipality is offering payments for farmers to adopt a specific practice to improve water quality, Quantified Ventures are able to show their model produces the same outcomes with 30% less cost because they measure and sell the outcomes, rather than paying for the adoption of practices with less reliable tracking of outcomes. This also makes for a more solid proposal to potential buyers of credits downstream.

The Soil and Water Outcomes Fund enrolled 10,000 acres through the Iowa Grain Association in no time at all in 2019. The company is looking to enroll ten times that number in the next two years, aiming for four to five million acres annually over the next five to seven years.

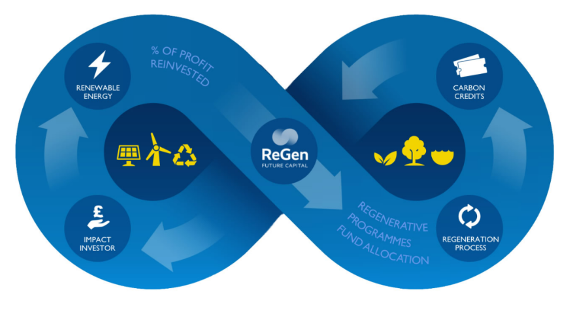

Regen Future Capital is a provider of finance to farmers looking to transfer to regenerative practices, by providing capital and recouping investment on profit made through carbon credits. The business model has the right incentives for the farmer to generate carbon credits, for the service provider to find a market to sell them and incentivizes investor engagement with carbon markets. The company may be looking for a new source of capital as Amplio Group’s support is contingent on the success of their solar power interests in southern Europe.

Source: Regen Future Capital

Source: Regen Future Capital

Many companies are designing the marketplaces are already agnostic to the type of ecosystem service payment they sell. Nori are clear that while carbon sequestration in agricultural soil is the first, it will not be the last, item they sell. Similarly, Regen Network are looking at many different methods of tracking regenerative practices, and providing access to payments to help farmers transition to better practices.

Challenges

These models rely on accurate ecosystem service accounting, a technological hurdle we covered in Part 2. However, while there is still debate around the accuracy of soil carbon accounting, there are already ecosystem service payment schemes up and running such as the Nutrient Trading scheme in the Chesapeake Bay Area.

There are strong grounds to believe downstream corporates will be willing to participate in these schemes. There is the Catskill watershed example in the 1990s, where New York City municipality paid farmers to use organic products to improve water quality in its watershed to the cost of $1.5 billion, making enormous savings on the $8 billion it would have cost to build wastewater treatment infrastructure. Convincing potential off-takers and buyers of credits is main challenge for Ecosystem Service Payment models.

Keep an Eye on…

Regulatory change. In the same way organic farmers gained access to cheap transition debt once the definition of organic was a regulated space, the pressure to legislate for a regenerative label in food may adjust the landscape for investment. There are many reasons why a clear regulatory definition for regenerative is much harder to clarify than organic, but soil health is a central pillar in the EU’s new Farm to Fork strategy, while the UK government has highlighted ecosystem service payments as a potential part of its post-Brexit farm bill.