Cars

Published on August 23rd, 2020 |

by Zachary Shahan

August 23rd, 2020 by Zachary Shahan

More in line with the US auto market’s trends than the European auto market’s trends, plugin vehicle market share in South Korea is at about 2% this year. Furthermore, it is dominated by just a few models.

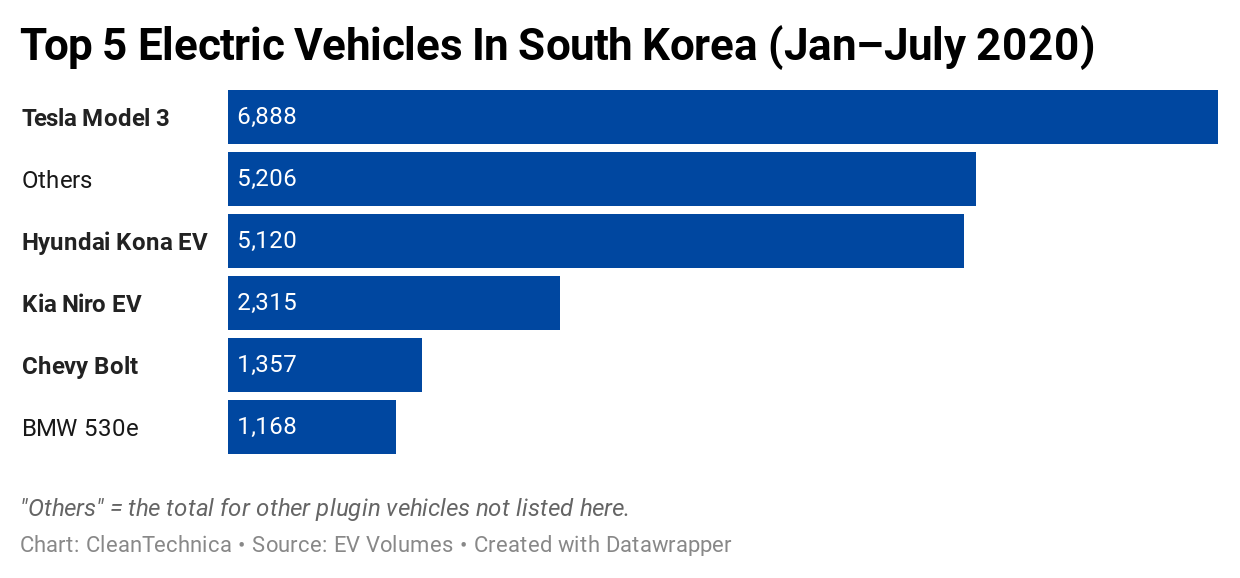

While Europe has dozens of electric vehicle models on the market (thank you, EU leadership), South Korea, like the US (especially outside of California), is a wasteland. Two models — the Tesla Model 3 (31%) and Hyundai Kona EV (23%) — account for 54% of the Korean EV market, according to EV Volumes. Add two more models — Kia Niro EV (10%) and Chevy Bolt (6%) — and you get up to 70% of the plugin vehicle market in South Korea.

While that may be exciting for fans of just one or two models or brands, it’s depressing for fans of the electric revolution. If Tesla sold the same number of Model 3s in South Korea, but plugin vehicles overall had 10% market share instead of 2%, the Model 3 would have a bit more than 6% market share despite having the same sales volume. That would be a much healthier market and one to celebrate much more.

While South Korea has just 2% plugin vehicle market share, the UK is at 8% market share (9% in July), Germany is at 8.5% (11% in July), France is at 9.2% (9.5% in July), Portugal is at 11.4% (12% in July), the Netherlands is at 12.1% (16% in July), Finland is at 15.7% (16% in July), Sweden is at 25.8% (29.5% in July), Iceland is at 53% market share, and Norway is at nearly 70%. South Korea could do better.

One problem in 2020, ironically, was Europe’s success. Hyundai and Kia have consistently underestimated consumer demand for years. It’s been hard to get their rather popular EVs as a result, with long waiting lists. In 2020, Hyundai and Kia had to sell a lot more EVs in Europe or be faced with steep fines. So they shipped more EVs to Europe … and took them away from the Korean market. As such, José Pontes of EV Volumes notes that the Kona EV’s sales were down 45% year over year in its home country.

Hyundai now has a factory in the Czech Republic where it is building the Kona EV for European buyers, which will theoretically allow Hyundai to deliver more cars in South Korea again, but the overarching problem of years of underestimating consumer demand is the frustrating part for EV fans, especially fans of Hyundai EVs.

The Korean market, like the Japanese market (but not nearly as severe), is having a disappointingly slow shift to electric vehicles. You might expect this from Trump country, but not from an advanced, highly developed, tech loving country like South Korea.

When will South Korea get its house in order and see plugin vehicles reach 10% market share of its overall auto market?

Appreciate CleanTechnica’s originality? Consider becoming a CleanTechnica member, supporter, or ambassador — or a patron on Patreon.

Sign up for our free daily newsletter or weekly newsletter to never miss a story.

Have a tip for CleanTechnica? Send us an email: [email protected]

Latest Cleantech Talk Episode