In this three-part series we will tackle investing in regenerative agriculture. Part I will provide an overview, part 2 will look at key technological and business model innovation, and part 3 will look at finance.

How do I invest in Regenerative Agriculture?

The investment landscape for regenerative agriculture can simultaneously look like a vast roadmap for the future of agriculture and, at the same time, a set of nascent, un-proven or at best, ‘early-stage’ technologies.

This conflict comes as there are two lenses to view regenerative agriculture through. On one hand,it is a generic term for improvements to the agricultural system; leaving the farm in better shape after harvest than before to increase overall farm resilience and productivity. On the other hand, there are specific technologies, business models, and markets being built to support specific regenerative agriculture goals or methods such as soil health and carbon sequestration or cover crops (see figure 1).

This reason for this conflict is twofold. Firstly, there is no clear definition of regenerative agriculture. It is a set of farming principles with only a few clearly defined goals. The second reason is that there is (currently) little regulatory framework for regenerative agriculture.

Given this lack of regulatory structure there are essentially two asset categories.

- The first category includes technological and business model innovations that are enabling the transition to regenerative agriculture. This category breaks into two further segments. In the first we place technologies such as robotic soil sampling and biological fertilizers. In the second, we place market-based solutions such as carbon removal marketplaces and ecosystem service payment schemes. Regulation is certainly moving to meet these companies, but some of the challenges outlined below explain why these two categories are higher-risk avenues for investment in regenerative agriculture.

- The second category is the real asset; the farm, where innovative financing models are increasingly being tested to transition a farm to regenerative practices.

Challenges and Opportunities

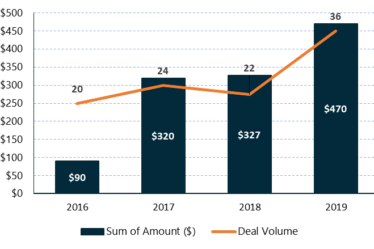

Financing the transition to regenerative agriculture is often cited as the key challenge. Capital availability is still relatively low, but growing. Alongside this, it is critical to de-risk the transition period for the farmer. Typical financial products such as those offered to help farmers transition to organic certification are often three-year agreements, whereas regenerative agriculture may require longer-term structures with less clear regulatory framework. Another key part to de-risking this investment for the farmer is to be able to show proven benefits. Here there are software tools such as MySoilCapital, borrowing from the OPower playbook and other levers, that can power this transition.

Measurement and verification of soil health is difficult and expensive at scale. Soil sampling for agronomic purposes is a well understood science, but sampling to enable the certification of ecosystem services such as carbon, nitrogen, or water sequestration is more difficult. To build effective marketplaces requires robust and proven technology.

Many attempts to measure the potential impact of carbon sequestration in agricultural soils have only focused on potential, rather than feasible, sequestration. This has led to much of the hype surrounding market-based solutions as claims such as the Terraton Initiative’s aim to sequester the amount of carbon that has been emitted since the beginning of the industrial revolution. Measuring what is feasible is a much more difficult task, and one that will require much investment in soil sampling techniques and data verification technology. Regenerative food products and brands such as Planet FWD or products from Patagonia Provisions will increasingly play an important role in promoting regenerative agriculture as consumer awareness increases. These companies are also working to make it easier for corporates to account for the ecosystem services embedded in the products they sell, requiring the stitching together of a variety of data streams to ensure regenerative credentials and providing large food corporates access to the information required to sell regenerative products.

The Industry is Running out of Time

“We likely don’t have time to wait for the majority of consumers to start eating for planetary reasons,” says General Mills soil scientist Steve Rosenzweig. It is going to require pioneering work from food corporations to bring about the transition. Corporates such as Danone are working with its dairy farmers to strike long term cost-plus contracts to help plan and finance the transition, while General Mills are committed to rolling out one million acres of regenerative agriculture by 2030. Further engagement examples include the FedEx investment in Indigo to boost its carbon marketplace, or the Kering Group’s commitment to one million hectares of regenerative agriculture. There are many ways for corporates to engage with their own supply chains or invest externally in regenerative agriculture innovation.

How to Accelerate the Transition

In the next two pieces on regenerative agriculture, we will look at what technological innovations and market-based innovations are likely to have the biggest impact. We will also examine the innovative business models and financial structures that are de-risking the regenerative transition.