In celebration of my first anniversary at Clean Energy Trust, I thought I would introduce myself. My name is Dylan O’Reilly and I’m Program Manager at Clean Energy Trust. As Program Manager, I oversee our investment process and assist in due diligence. I also act as the communication bridge between investment applicants, other external stakeholders, and the investment team, helping to ensure that our investment cycles run smoothly from start to finish.

In celebration of my first anniversary at Clean Energy Trust, I thought I would introduce myself. My name is Dylan O’Reilly and I’m Program Manager at Clean Energy Trust. As Program Manager, I oversee our investment process and assist in due diligence. I also act as the communication bridge between investment applicants, other external stakeholders, and the investment team, helping to ensure that our investment cycles run smoothly from start to finish.

A little about me

I have a puppy named Beans. I studied and worked in California for 5 years before returning to the Midwest where I was born and raised to earn a Master’s in Urban Planning and Policy at University of Illinois at Chicago. Yes, of course, I occasionally miss the ocean and perfect weather, but I’m a runner and there’s nowhere else I’d rather be than running on Lake Michigan’s flat, flat lakefront with the cool breeze coming off the water.

I truly believe that technology has an important role to play in how we tackle climate change and build a new future that is both environmentally sustainable and equitable. Working at Clean Energy Trust has affirmed these beliefs and provided me the opportunity to learn from some of the best in the industry.

But, enough about me

But, enough about me

As the keeper of the Clean Energy Trust investment process, I thought I’d share an overview of how we operate. That’s right — full transparency.

Sharing the ins and outs of our investment process will help entrepreneurs understand the qualifying criteria, the mechanics, and timing before our fall investment cycle deadline of August 3rd, and those interested in volunteering can get involved in that process.

Clean Energy Trust’s investment process

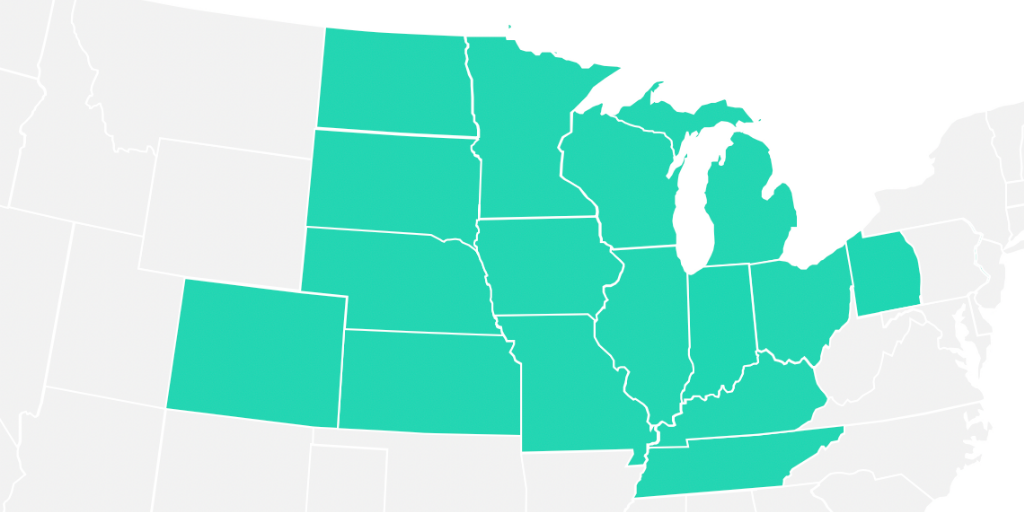

Based in Chicago, Clean Energy Trust is a nonprofit that invests in early-stage cleantech startups in the Mid-Continent region of the United States. Here’s how it works.

We accept applications for investment on a rolling basis. However, twice a year we conduct formal investment cycles. We believe our rolling investment process allows our investment platform to be fully open and inclusive by providing companies the ability to introduce themselves via our application process throughout the year.

We are currently looking for early stage cleantech startups to apply for our fall investment cycle ahead of our August 3rd deadline. Any applications received after August 3rd will be considered for the following cycle in early 2021.

Our 501vc® Seed Fund invests $100k — $300k in early stage cleantech startups — typically pre-seed/seed stage — in the Mid-Continent region of the United States. For eligibility details, please review and apply at https://www.cleanenergytrust.org/apply

The sectors we support

As stated above, we support early stage cleantech startups based in the Mid-Continent region of the United States. We also sometimes call them climate tech startups. Whatever our industry is calling it these days — we know it is important to define our terms.

Just as the climate tech industry is ever evolving, so are the sectors Clean Energy Trust supports. While we are always open to innovations in other sectors that drive environmental sustainability, but the investments we make generally fall into the following sectors:

- Electricity

- Materials and Manufacturing

- Water

- Food and Agriculture

- Transportation

Our cycle structure

We start the cycle by welcoming early stage cleantech startups in the Mid-Continent region of the United States to apply to our program through direct outreach to our ever growing database of startups, as well as calling upon our wide network of ecosystem partners for referrals. Our application is relatively brief and should take less than 30 minutes. First, you’ll need to submit a formal pitch deck or detailed 1-pager. If you are not sure what is needed in your pitch deck, you can always refer to our handy How-To Guide located on our application page. We also ask that you tell us a little bit about your technology and the problem it is aiming to solve.

Once your application is submitted, we review your company using three screening questions:

- Which sector does your company fall under?

- Where is your company located?

- What stage is your company?

Before starting your application, I welcome you to ask yourself these three questions.

After narrowing down applicants, we begin the evaluation process. During this secondary stage of due diligence, we may reach out with additional questions. At this time, we also engage our invaluable volunteers, the Clean Energy Trust Subject Matter Experts (more on this volunteer opportunity below).

Next, we invite a portion of companies to pitch us virtually. These webinars serve as an opportunity for companies to formally pitch to our investment team, and allows us to ask questions.

Following the initial virtual pitch, we invite a subset of companies to participate in an in-person or virtual Deep Dive session. Deep Dive meetings are 3-hour sessions where you will have the opportunity to pitch to the entire Clean Energy Trust team and meet with our Investment Team to discuss your company on a detailed level. At this time, you will submit diligence documents to us for review.

Now, it’s time for a third and final pitch, which will be in front of our Investment Committee. Our Committee is composed of a world-class team of investors from top-tier venture funds and corporate strategy executives from industry-leading global firms who recognize the important role Clean Energy Trust plays in helping emerging cleantech companies succeed. Typically, anywhere from 4–6 companies participate in this final presentation.

After further review and examination, we will make our final investment decision. As we like to say, Clean Energy Trust does not just invest in companies, we form lifelong partnerships with the goal of helping you succeed. Companies whom we invest in will receive hands-on support from our investment team and will join our welcoming ecosystem of portfolio companies.

Our Network of Subject Matter Experts

We’ll be the first to tell you — our team doesn’t know everything, about everything. And we are not afraid to ask questions. We like to do our homework and explore new domains. This includes tapping our network of smart people with diverse backgrounds and expertise.

Do you identify as a smart person with expertise?

Don’t be so bashful!

Ok, what if we asked your colleague, partner, or a friend, would they say you are a subject matter expert?

Now we’re getting somewhere.

And are you interested in startups and innovation?

Great! We’d like to invite you to join our network of Subject Matter Experts!

Our network of subject matter experts is an invaluable resource that we engage when diligencing investment opportunities. By volunteering as a Clean Energy Trust Subject Matter Expert, you can get a glimpse into our applicant pipeline, and help to ensure we deploy our capital and resources into the most promising cleantech startups in the region.

Once you’ve completed our brief sign-up form, your contact information will be securely kept in our database and we will only contact you if we are evaluating a company relevant to your area of expertise.

When we identify a company or set of companies that align with your area of expertise, we will reach out to you via email to schedule a 30-minute phone call where we can discuss the technology and hear your thoughts as an expert. You’ll receive all the necessary company information ahead of time, so you’ll be fully prepared to share your insights.

By volunteering as a Clean Energy Trust Subject Matter Expert, you can help to ensure high impact cleantech startups receive that essential seed funding. Join us in supporting cleantech innovation. With your help, we can find and fund startups working on solutions for clean energy, decarbonization, and environmental sustainability.

. . .

Please contact me — [email protected] — with any questions you may have regarding our investment process or subject matter expert volunteer opportunities.

Read more of our news and perspectives on Medium.

But, enough about me

But, enough about me