In 2015, I was sitting with representatives of Strata Solar, Southern Company and the Arkansas Public Service Commission, waiting to go onstage. We were the last session of the last day of the conference in question — a tough time slot.

The speakers were talking about that bit of bad luck and joking that utility solar doesn’t get any love. Then someone chimed in, “Demand response, EVs, flow batteries — those are cool subjects. But the four of us know utility solar makes the real impact. We are big, but boring.”

In the second quarter of 2020, the U.S. hit 50 gigawatts of cumulative operating utility solar, without much pause to consider how momentous a milestone it was. In 2011, utility solar reached 1 gigawatt. It took roughly nine years for the country to hit 50 gigawatts, but now it’s on track to reach 100 gigawatts by the end of 2023. Under Wood Mackenzie’s current forecast, U.S. utility solar will surpass 250 gigawatts by 2029 and reach more than 1 terawatt of utility PV somewhere between 2042 and 2045.

Onshore wind currently is the top technology for annual capacity additions in the U.S. It will hold the No. 1 spot until 2022 when the combination of the stepdown of the federal Production Tax Credit and the growth in solar causes wind to drop to second place.

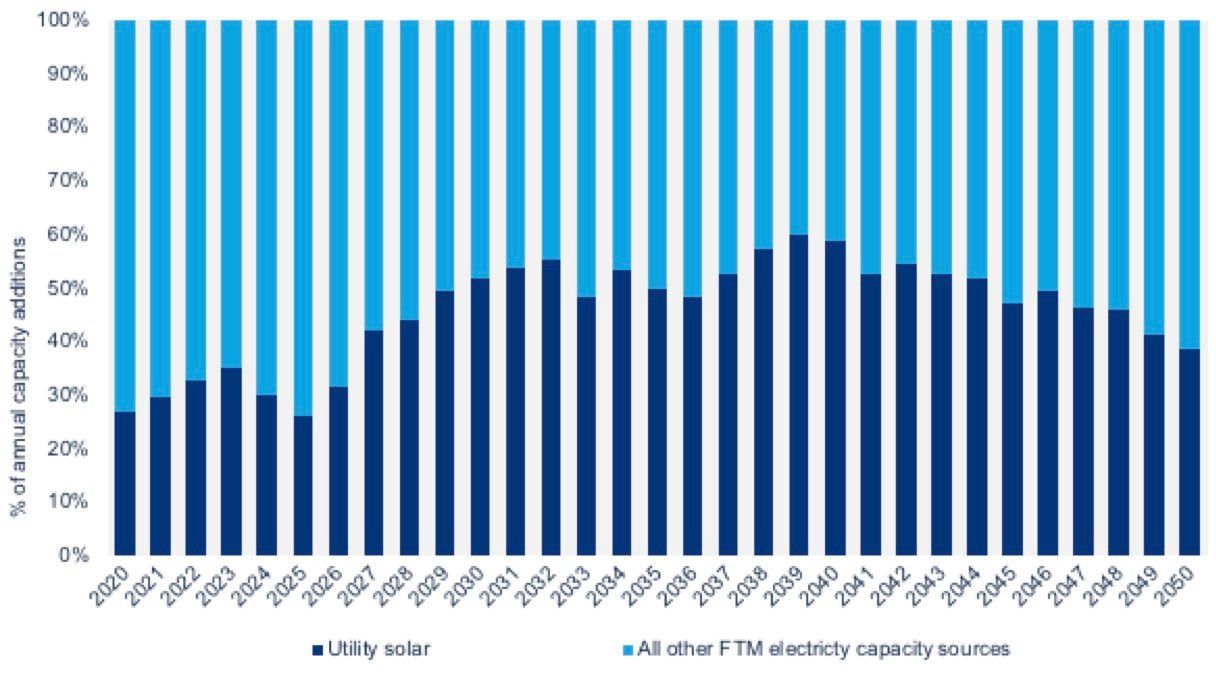

But the growth doesn’t stop there. Annual additions of solar will keep increasing. By 2029, utility solar will see more annual capacity additions than onshore wind, offshore wind, natural gas, battery storage, and all other capacity generation sources combined.

In short, utility solar is the first wave in the revolution that will lead to a carbon-free economy. We will need other carbon-free technologies, of course. Onshore and offshore wind will continue to be built, distributed generation will flourish, and new infrastructure such as microgrids will allow the grid to be more resilient and reliable. Through this energy grid evolution, large-scale PV will be the vanguard.

That much new solar will also spur its own set of problems. Transmission build-out might be the limiting factor for growth of solar or energy storage and dictating the pace of change. Permitting or NIMBY issues will continue to arise across the country for large-scale and small-scale developers alike. Financing the vast build-out will prove challenging and finding funding could prove to be challenging to some developers. Finally, there’s the looming question of energy-market redesign to handle high levels of solar and renewables penetration, and what that new design might look like.

But these challenges to how fast utility solar grows take it for granted that it will, in fact, see such enormous growth. Despite these potential hurdles, more states, utilities and corporations are passing carbon-free energy or 100% renewables plans. This helps increase our certainty that utility-scale solar, as the country’s dominant energy technology, will play a defining role in how the U.S. energy infrastructure changes over the coming decades.

***

Colin Smith is a senior analyst at Wood Mackenzie, leading coverage of U.S. utility-scale solar PV.