In this month’s August Cleantech Roundup, we’re talking about partnerships between automakers and electric vehicle charging companies, the recent rolling blackouts in California, and why cleantech investing today may fare better than a decade ago.

The theme of the month is transitions: how do automakers, grid operators, and investors navigate the transitions underway in their respective spaces to ensure they succeed?

We’ll also touch on some of the recent cleantech investment, policy, and technology news, and more.

Automakers Paying for Electric Vehicle Charging Infrastructure — Fool’s Errand, or Smart Investment?

GM and EVgo announced plans to build 2,700 fast EV chargers over the next five years (Link). An article in E&E News argues that the GM/EVgo deal is not that great for GM, because it doesn’t offer exclusivity for GM vehicles the same way Tesla has an exclusive network.

I don’t agree — replicating Tesla’s single brand network is unlikely to be practical or wise for GM, which is transitioning to EVs more slowly. In general what matters is the access to the network, not the brand or exclusivity of the network. All EV owners care about is whether there is sufficient charging infrastructure for where they travel with their vehicles and that the stations work.

EVgo focuses exclusively on fast-charging stations, which matters more for extended travel (consumers care about fast charging on road trips, but most of the time can slowly recharge at their home or office). This is a rising tide lifts all boats situation from my perspective (outside of Tesla’s network, all new electric vehicles can plug into any charging network, and the networks themselves will most likely be required to be interoperable in the future as well).

This doesn’t mean Tesla’s integrated strategy is a bad one either — they are just pursuing different models. Indeed, if GM can selectively pay to install a limited number of fast-charging stations at key locations to help ease consumer adoption, that can be money extremely well spent, as they can ride the coattails of other investments in charging infrastructure more generally.

E&E News is suggesting GM is paying for the station and getting little in return; I’m suggesting what they are getting in return is that they won’t need to invest 10x in a complete charging network (which would be capital intensive and is not their competency).

Meanwhile, Bloomberg argues that Electric Car Chargers are the Final Roadblock to America’s Electric Car Future. Well, yes and no. Don’t get me wrong, we’ll definitely need a robust high-speed charging network for most vehicles to transition to electric, that’s true.

While the article points out that many very rural areas have huge gaps in charger access, where consumers are buying EVs today (overwhelmingly on the coasts), this is generally not the case. Price and battery capacity are bigger hurdles right now than charging infrastructure, speaking anecdotally as someone currently shopping for a car.

A few other things to keep in mind: charging stations aren’t all that expensive of infrastructure to install (around $6k for a level 2 charger, around $50k for a level 3 charger, not including the cost of utility upgrades) — not trivially cheap, but we’re not talking about unseemly amounts of money here. Unlike some commercial services, they are a benefit, not a detriment, to the communities they are installed in, so are unlikely to face opposition.

Additionally, for fast charging, the charging limit is not a result of the actual charger, it is the batteries — new fast chargers are equipped to handle charging rates several times quicker than most electric vehicles on the market today. So, new fast-charging stations will be forward compatible long into the future, and faster-charging rates will also significantly increase the throughput capacity of any one charger.

So, we collectively definitely need to install a whole bunch of fast EV chargers as part of the EV transition, but I don’t think the lack of chargers is all that big of a problem at the low EV penetration rates we have today. Many of these future chargers will be installed once enough EV traffic exists to support high utilization rates.

Credit: Yichuan Cao/NurPhoto via Getty Images

Why Were Californians in the Dark?

In California, rolling blackouts occurred in parts of the state in response to a heat wave. What happened? It’s complicated. This piece from Alex Gilbert and Morgan Bazilion lays things out well.

The blackout appears to have been caused by a combination of:

- a heat wave (increasing the demand for electricity and may have caused a couple of gas plants to trip offline),

- market structure (California lacks market mechanisms such as a capacity market which can encourage large-scale demand response and the development of new energy resources),

- climate change (increasing the frequency and intensity of heat waves) and

- operator decision making (while demand was high, it did not set a record; reserve margins were also above critical thresholds; California ISO routes power for 80% of the state and implemented the blackouts, although Sacramento and Los Angeles, which are both managed by municipal utilities, did not have blackouts).

While some were quick to blame renewables, California ISO indicated this crisis was unrelated (although as we increase the penetration of renewables on the system, managing the grid does get more complex). Link

Will This Time Be Different? Yes.

Back in 2016, my former colleague Dr. Ben Gaddy published research on what went wrong during the cleantech 1.0 bust during the prior decade. He called out three areas where growth needed to occur (and was starting to occur) to help support a successful cleantech ecosystem: 1) growth in publicly-funded energy commercialization initiatives, 2) new sources of funding, and 3) better acquisition options.

Last month, investor (and Clean Energy Trust Investment Committee member) Rob Day wrote a piece in Forbes providing an update on the resurgence in cleantech investing. He recapped the history of some of the things that went wrong from his perspective and shared why he’s optimistic now.

I agree with his optimism. Day noted there are now additional financial solutions available beyond traditional venture capital (including more active family offices, program-related investment, project finance for emerging solutions, and very early stage support like incubators and accelerators).

In addition, Day noted there are better potential acquirers on the scene now — oil and gas supermajors in particular. While the proof will be in the pudding of major acquisitions and public offerings, it is exciting to see progress for the cleantech investing ecosystem — especially progress directly in line with areas of need outlined in earlier research. Link

What’s up with Tesla’s Stock?

While discussing the spate of newly public electric vehicle companies in last month’s July Cleantech Roundup, I said “Tesla’s stock has also been going gangbusters in a manner that defies explanation from market watchers.”

While I think that statement remains generally true, I did see an interesting perspective arguing for why Tesla could be priced correctly today which I wanted to share from Olaf Saakers with Maniv Mobility, a mobility-focused venture fund based in Tel Aviv.

Here’s a paragraph from the piece that summarizes things:

So the argument that Tesla is priced “correctly” goes as follows: Cars are becoming digital through silicon centralization and function defining software built on top of it. Tesla has chosen to vertically integrate and is way ahead of incumbents especially when it comes to software updates, shorter update cycles and cybersecurity, giving it a sustained advantage. Software is what propels Tesla forward and what holds its incumbents competitors back. Betting on Tesla is a bet that software advantages are deeply rooted and will continue to deliver sustained competitive advantages through novel functionality and that these advantages will only grow with greater access to capital and scale. And it is also a bet against the rest of the automotive industry — that it can’t catch up, leverage its currently far greater scale and specialized supply base to tap into the same digitization that has allowed Tesla to succeed.

Wither Methane?

The Trump administration announced they were eliminating a regulation that required oil and gas companies to monitor and limit methane leaks. This is super interesting because it appears to be ideological rather than business-focused: large oil and gas industry players are publicly opposed to this rollback (although some smaller producers supported it).

Why would the industry oppose less regulation? Because they don’t want natural gas to be portrayed as an uncontrolled climate change problem — they want to make the case that they are part of the solution (emissions have dropped largely because of the power sector’s shift from coal to natural gas, which emits less CO2) rather than part of the problem (methane is a much more concentrated greenhouse gas than CO2, so leaks are extremely problematic). Link

NMC, Yeah You Know Me

Greentech Media predicts lithium-iron-phosphate (LFP) batteries will overtake lithium-manganese-cobalt-oxide (NMC) batteries for stationary storage applications. These different formulations of lithium-ion batteries offer different attributes — while NMC is more energy-dense, LFP is likely to be a better fit for stationary applications because it is able to be cycled more frequently with less degradation (which is useful if you are supporting the grid). It is an example of the battery industry continuing to mature and build different solutions optimized for different use cases. Link

Credit: U.S. Department of Energy

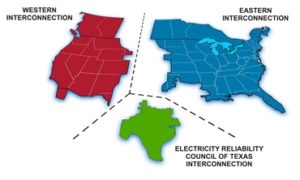

Seams in the Grid

This piece in The Atlantic highlighted how the Trump Administration buried a valuable study about integrating the grid systems that exist in the U.S. (one east of the Rockies, one in the west, and one in Texas). This was useful data that showed the benefits of connecting these seams, and it is disheartening to see this research quashed.

That said, as Jigar Shah pointed out on Twitter and on the Energy Gang podcast, it’s not like this study was the critical path item for eliminating the seams in the grid — political roadblocks are more significant. Link

Keep Rollin’ Rollin’ Rollin’ Rollin’

Earlier this year, Angel List introduced a new product/mechanism for first-time funds — a rolling fund structure.

There are some complexities here, but essentially it allows fund limited partners to commit to invest in a fund for a number of quarters (instead of a decade), which should in theory allow a new fund to raise their dollars over a much longer period of time, and potentially from people who write smaller checks as well.

This seems like it addresses some key challenges for first-time funds; that said, investors tend to be skeptical of non-standard fund structures.

Very interesting possibilities; it’ll be interesting to see how this works in practice. Jason Jacobs of My Climate Journey recently shared he is taking this approach for a new Climatetech-focused fund. Link

MIT task force predicts fully autonomous vehicles won’t arrive for ‘at least’ 10 years

Hat tip to Trucks’ Future of Transportation for highlighting this one. Link

Who is an Accredited Investor?

The SEC has broadened the definition of an Accredited Investor. The definitions were dated and a bit arbitrary and meant that some highly credentialed investment professionals didn’t qualify because they didn’t have sufficient income or wealth. I think this is an area where we can actually continue to loosen restrictions, potentially letting individuals take a test to qualify directly. Link

Other Links

BP announced over the next decade they would invest an order of magnitude more in renewables and expected to produce 40% less oil. Link

Clean Energy Trust portfolio company Wright Electric was awarded an ARPA-E grant to design better electric motors for aviation. Link

Chicago based S2G Ventures, a food and ag focused firm, announced a new $100 million fund focused on seafood and other ocean startups. Link

Read more of Clean Energy Trust’s news and perspectives on Medium.